For Sponsors

Cohesive is a flexible, creative, and easy to work with partner, and seeks to add value beyond just providing capital.

“User-Friendly” Sponsor Interaction

Highly responsive, transparent, and efficient – never waste sponsor’s time

Constantly communicate

Review materials and give feedback quickly (“Quick No’s”)

Able to operate under accelerated timelines

Thoughtfully prepare for meetings with sponsor and/or management

No unnecessary internal bureaucracy

COHESIVE PROCESS

The “50%" Rule”: If at any point during the process, Cohesive is less than 50% likely to do the deal, we will drop so as not to waste the sponsor’s time or hang around the hoop and risk leaving the sponsor “at the altar”

Flexible Solutions

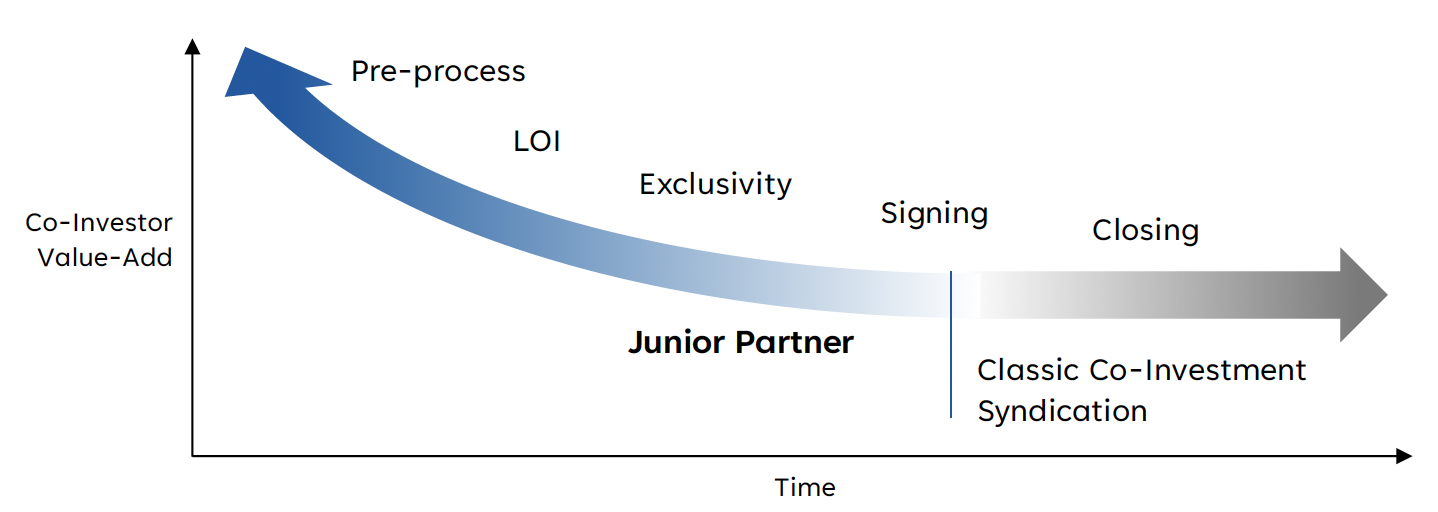

Cohesive is set up to work with sponsors early in a process as a Junior Partner to reduce co-investment syndication risk and give sellers confidence

Support new or existing investments

Comfortable with accelerated timelines and complex situations

Willing to be creative to find situation-specific solutions

Flexibility also allows Cohesive to be helpful in a variety of other potential situations:

BRIDGE TO CLOSING OF A NEW FUND

LEGAL/REGULATORY OWNERSHIP LIMITATIONS

CAPITAL FOR ADD-ON ACQUISITIONS

GROWTH CAPITAL FOR PRODUCT OR SALES INVESTMENT

INDEPENDENT VALIDATION OF CROSS-FUND INVESTMENTS

SECONDARY PURCHASE FROM PREVIOUS OWNER / CO-INVESTOR

Value-Added Knowledge Network

Cohesive leverages its Knowledge Network to:

Provide additional insights during due diligence

Introduce potential customers or strategic partners for portfolio company

Facilitate introductions to bankers and debt financing sources

Cohesive’s Knowledge Network Includes:

200+ value-added LPs

Corporate executives

Bankers

PE professionals

Lenders

Public market investors